26+ Apartment depreciation calculator information

Home » Wallpapers » 26+ Apartment depreciation calculator informationYour Apartment depreciation calculator images are available in this site. Apartment depreciation calculator are a topic that is being searched for and liked by netizens today. You can Find and Download the Apartment depreciation calculator files here. Download all royalty-free vectors.

If you’re looking for apartment depreciation calculator pictures information connected with to the apartment depreciation calculator interest, you have come to the ideal site. Our site always gives you suggestions for seeking the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

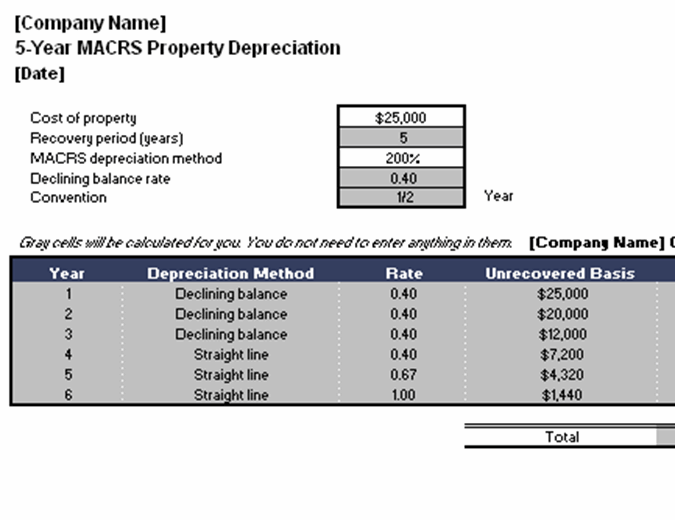

Apartment Depreciation Calculator. The BMT Tax Depreciation Calculator helps you to estimate the likely depreciation deductions claimable for all types of property including residential commercial and manufacturing buildings. If you buy a property that trades at an 8 cap rate then raise the net operating income of the property by 5000 you can divide that by the 8. In January 2019 it was valued at 250000. The value of the home after n years A P 1 R100 n.

How To Use Rental Property Depreciation To Your Advantage From baymgmtgroup.com

How To Use Rental Property Depreciation To Your Advantage From baymgmtgroup.com

C is the original purchase price or basis of an asset. The calculator will provide some insight into optimised tax depreciation schedules and how much they can increase the tax deduction for your property getting you a better tax return. Same Property Rule. For instance if a buyer is selling a property after 10 years of construction the selling price of the structure can be calculated through following formula-. One simple way to think about cap rate is the amount an investor will pay today for a future revenue stream. You can also calculate the depreciation by using the.

How to Calculate Depreciation on a Rental Property By Cathie Ericson.

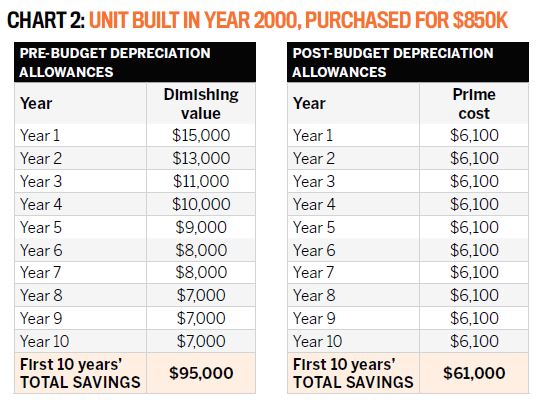

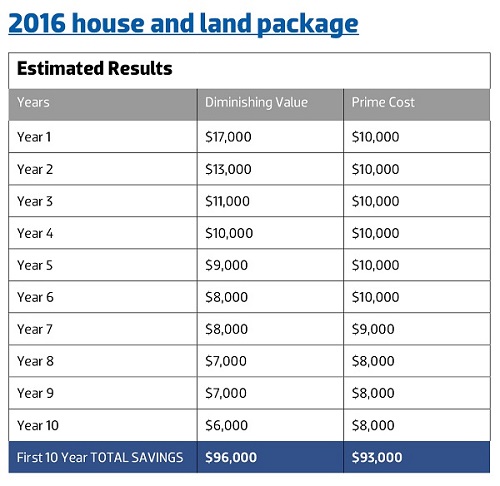

Lets suppose that the multiplying factor is k. If you create myGov account and link it to ATO you can save your records and calculations for use in your tax return. Where Di is the depreciation in year i. Estimated deductable amounts for the first 10 fiscal years starting from the purchase date. Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property. The value of the home after n years A P 1 R100 n.

Source: thepropertycalculator.com.au

Source: thepropertycalculator.com.au

Rental properties are known to yield anywhere from five to 10 percent with some investments even going above ten. Same Property Rule. Calculate Property Depreciation With Property Depreciation Calculator. Rental properties are known to yield anywhere from five to 10 percent with some investments even going above ten. One simple way to think about cap rate is the amount an investor will pay today for a future revenue stream.

Source: docs.google.com

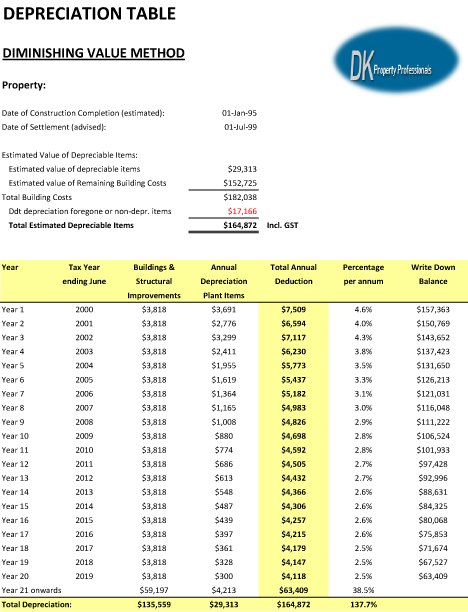

Where Di is the depreciation in year i. Ri is the depreciation rate for year i depends on the assets cost recovery period. The results will display the minimum and maximum depreciation deductions that may be available for your investment property between 1 and 5 full years. The BMT Tax Depreciation Calculator helps you to estimate the likely depreciation deductions claimable for all types of property including residential commercial and manufacturing buildings. The MACRS Depreciation Calculator uses the following basic formula.

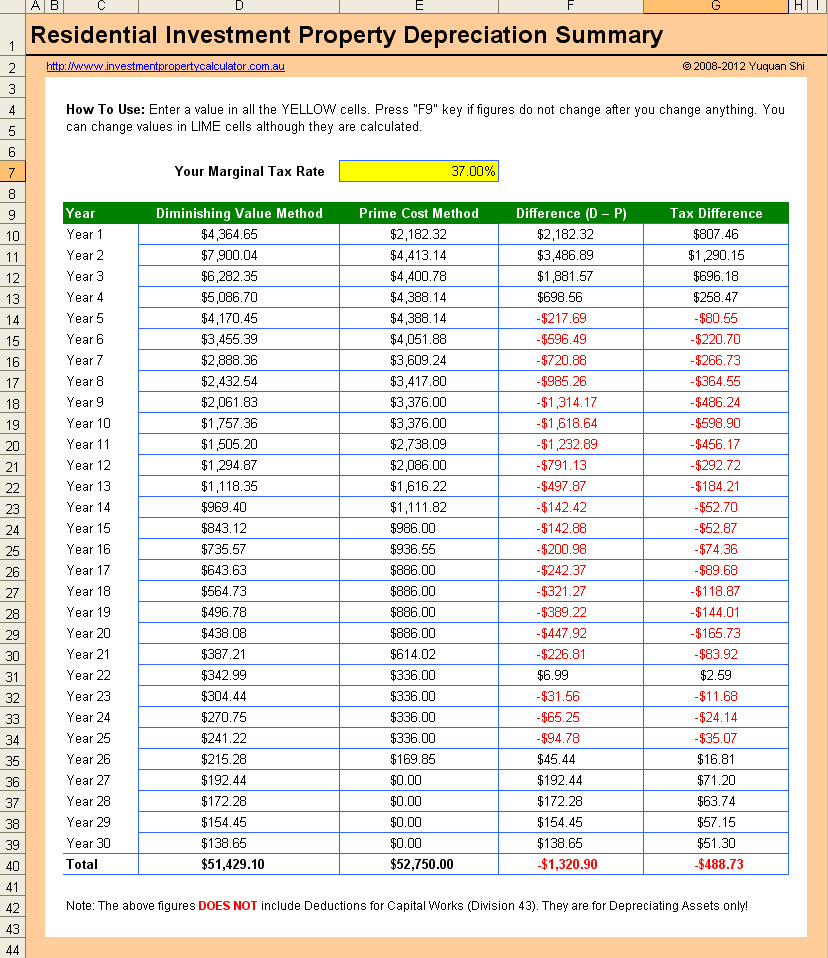

Source: investmentpropertycalculator.com.au

Source: investmentpropertycalculator.com.au

Using the ATO depreciation calculator. Where Di is the depreciation in year i. In January 2019 it was valued at 250000. A house was bought for 200000 in January 2014. How to Calculate Depreciation on a Rental Property.

Source: blog.capitalclaims.com.au

Source: blog.capitalclaims.com.au

Check your Property Tax Depreciation Deductions Today. If you create myGov account and link it to ATO you can save your records and calculations for use in your tax return. The depreciation calculator should be used more as an indication as opposed to a final accurate figure. To calculate the ROI of a property take the estimated annual rate of return divide it by the property price and then convert it into a percentage. Estimated deductable amounts for the first 10 fiscal years starting from the purchase date.

Source: realestate.com.au

Source: realestate.com.au

You can also calculate the depreciation by using the. Depreciation schedule calculator Verified 1 days ago. You can also calculate the depreciation by using the. Where Di is the depreciation in year i. The value of the home after n years A P 1 R100 n.

Source: bmtqs.com.au

Source: bmtqs.com.au

Where Di is the depreciation in year i. In January 2019 it was valued at 250000. Calculate the average annual percentage rate of appreciation. Lets suppose that the multiplying factor is k. Estimated deductable amounts for the first 10 fiscal years starting from the purchase date.

Source: rent.com.au

Source: rent.com.au

This is why you may find some resale apartments as costlier than their original buying cost. The seller knows the average value of property and would be willing to spend - 5 per cent of the market price. A house was bought for 200000 in January 2014. D i C R i. The cap rate calculator alternatively called the capitalization rate calculator is a tool for all who are interested in real estateAs the name suggests it calculates the cap rate based on the value of the real estate property and the income from renting itYou can use it to decide whether a propertys price is justified or to determine the selling price of a property you own.

Source: depreciationguru.com

Source: depreciationguru.com

D i C R i. Investors who own apartments units or townhouses which are part of a larger complex are also able to claim depreciation on common property items such as driveways fire equipment lifts and. To calculate the ROI of a property take the estimated annual rate of return divide it by the property price and then convert it into a percentage. Check your Property Tax Depreciation Deductions Today. In other words you take the cost basis of the building not the land and divide it by 275 years to calculate your annual deprecation amount.

Source: duotax.com.au

Source: duotax.com.au

Calculate the average annual percentage rate of appreciation. Calculate the average annual percentage rate of appreciation. Calculate Property Depreciation With Property Depreciation Calculator. The results will display the minimum and maximum depreciation deductions that may be available for your investment property between 1 and 5 full years. In other words you take the cost basis of the building not the land and divide it by 275 years to calculate your annual deprecation amount.

Thus the appreciation of the land is usually included in the total value of resale apartments. Thus the appreciation of the land is usually included in the total value of resale apartments. How to Calculate Depreciation on a Rental Property By Cathie Ericson. To calculate the ROI of a property take the estimated annual rate of return divide it by the property price and then convert it into a percentage. Calculate the average annual percentage rate of appreciation.

Source: yourinvestmentpropertymag.com.au

Source: yourinvestmentpropertymag.com.au

However weve strived to make this property tax depreciation calculator as accurate as possible according to the available data we have based on the thousands of properties weve inspected. A 250000 P 200000 n 5. This calculator performs calculation of depreciation according to the IRS Internal Revenue Service that related to 4562 lines 19 and 20. The value of the home after n years A P 1 R100 n. This is why you may find some resale apartments as costlier than their original buying cost.

Source: bmtqs.com.au

Source: bmtqs.com.au

This calculator performs calculation of depreciation according to the IRS Internal Revenue Service that related to 4562 lines 19 and 20. Calculate Property Depreciation With Property Depreciation Calculator. The MACRS Depreciation Calculator uses the following basic formula. Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property. How to calculate depreciation of property.

Source: rent.com.au

Source: rent.com.au

This is why you may find some resale apartments as costlier than their original buying cost. If you create myGov account and link it to ATO you can save your records and calculations for use in your tax return. Suppose the price of your property is Rs 100 and a buyer would have to incur an expenditure of Rs 12 to repairrenovate the house ideally the seller should be selling the house for Rs 88. A 250000 P 200000 n 5. This is why you may find some resale apartments as costlier than their original buying cost.

Source: templates.office.com

Source: templates.office.com

How to Calculate Depreciation on a Rental Property. To calculate the ROI of a property take the estimated annual rate of return divide it by the property price and then convert it into a percentage. The BMT Tax Depreciation Calculator helps you to estimate the likely depreciation deductions claimable for all types of property including residential commercial and manufacturing buildings. If you still feel you should ask for Rs 100. However weve strived to make this property tax depreciation calculator as accurate as possible according to the available data we have based on the thousands of properties weve inspected.

Source: duotax.com.au

Source: duotax.com.au

The calculator will provide some insight into optimised tax depreciation schedules and how much they can increase the tax deduction for your property getting you a better tax return. The ATO has a calculator which you can use. If you buy a property that trades at an 8 cap rate then raise the net operating income of the property by 5000 you can divide that by the 8. The cap rate calculator alternatively called the capitalization rate calculator is a tool for all who are interested in real estateAs the name suggests it calculates the cap rate based on the value of the real estate property and the income from renting itYou can use it to decide whether a propertys price is justified or to determine the selling price of a property you own. Check your Property Tax Depreciation Deductions Today.

Source: baymgmtgroup.com

Source: baymgmtgroup.com

Calculate Property Depreciation With Property Depreciation Calculator. In other words you take the cost basis of the building not the land and divide it by 275 years to calculate your annual deprecation amount. By using the NBtax property tax depreciation calculator you can measure your potential depreciation allowances for a free-standing house townhouse duplex or apartment currently rented out or even a property you are considering buying as an investment in the future. The value of the home after n years A P 1 R100 n. C is the original purchase price or basis of an asset.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

Where Di is the depreciation in year i. Using the ATO depreciation calculator. Check your Property Tax Depreciation Deductions Today. Note this is general in nature and not specifically for individuals investing in property. Suppose the price of your property is Rs 100 and a buyer would have to incur an expenditure of Rs 12 to repairrenovate the house ideally the seller should be selling the house for Rs 88.

Source: investmentpropertycalculator.com.au

Source: investmentpropertycalculator.com.au

Also in case of independent houses the building component depreciates whereas land is valued at market price. How to calculate depreciation of property. How to Calculate Depreciation on a Rental Property. Check your Property Tax Depreciation Deductions Today. The seller knows the average value of property and would be willing to spend - 5 per cent of the market price.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title apartment depreciation calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 22++ Amaryllis apartments zakynthos ideas

- 17++ Agent home ready to use apartments info

- 39+ All things fall apart pelicula completa en espaaol ideas

- 42+ Abbott landing apartments andover ma ideas in 2021

- 23++ Accra luxury apartment cantonment ideas in 2021

- 39+ Acapella apartments north las vegas ideas

- 17++ Antique apartments krakow old town info

- 49+ Adobe ranch apartments in henderson nv information

- 48+ Apartment complexes in concord ca info

- 49++ Apart jewellery online info